On April 26 we learned this – Minnesota AG tells “60 Minutes”: We didn’t have evidence George Floyd’s killing was a hate crime. The article relates that the CBS “60 Minutes” anchor observed to the Minnesota Attorney General that “the whole world sees this as a white officer killing a Black man because he is Black,” and asked him why that officer, Derek Chauvin, wasn’t charged with a hate crime. The AG’s answer: because though the whole world does indeed see it as a white officer killing a black man because he is black, and people rioted all summer on that basis (and are still rioting for that reason in Portland), and Black Lives Matter’s whole reason for existence and basis for accumulating the influence that they have is that kind of belief, and Democratic politicians are still reaping the political benefits of that belief and happily affirming that belief – a belief that undebatably causes hatred, hatred of police – there is practically zero evidence that it is true. (I think that BLM has done a lot of good conscious-raising about police along with a lot of defamation, by the way. There is much nuance.)

Here I will not say anything in defense of Derek Chauvin, except that, as mentioned, there is no concrete evidence that he is a racist. When most people watch the video, he impresses them as a monster, and he may be. He may also be a racist. But there is no concrete evidence that he is a racist, so anyone who flatly calls him a racist must have some manipulative agenda. Establishing him as a monster confers few political benefits compared to establishing him as a racist.

Anyway, there is a false (or at least unsubstantiated) belief that white officers kill black men because they are black. What may have been the most serious attempt so far to study the subject dispassionately has been that of Roland Fryer, a Harvard economist who is himself black. He concluded, On the most extreme use of force – officer-involved shootings – we find no racial differences in either the raw data or when contextual factors are taken into account.

A lot of data is available about police shootings, but I have been unable to find any academic attempt at all to examine possible race-related differences between rates of police killings by shooting and by other means, and it is not obvious why any racial bias should cause outcomes for the other means that are different than for the shootings. So if we are not to assume that Fryer’s data about shootings (which must account for the big majority of killings) more or less represent data about all police killings as best they can presently be represented, it seems to me that the burden is on those who contest that idea to show why.

But naturally those who hold the unfounded belief will think that those who share that unfounded belief with them have better judgment than those who dispute that unfounded belief; and moreover will think that those who share it are supporting blacks over a valid issue. So there are two corollary unfounded beliefs: one, that Democrats, in that one dimension at least, have better judgment than do Republicans, and two, that Democrats are supporting blacks on a valid existential issue.

Democrats are getting elected due to these two unfounded beliefs, particularly the unfounded belief that Democrats are supporting blacks over a valid issue. That unfounded belief may be providing them the margin of victory in the national power sweepstakes. Let’s suppose that’s true and park that thought temporarily in our minds.

Meanwhile over at the abortion clinic, the black population is being decimated. In New York City, more black babies are aborted than are born alive, which is not nearly true for other races. Nationwide, the outlook for black babies is not so grim, but still the abortion rate greatly outpaces the rates for the unborn of other races. It nears triple the rate for white babies.

So over at the abortion clinic, the decimation of the black population proceeds apace. The above figures are in terms of the average number of abortions in a year for a woman of a given race (stated in practice as the total number for 1000 such women), but we can also look at figures that calculate the likelihood of abortion for any one pregnancy. “Decimation” originally meant the killing of one in every ten of a group of people. The statistics say that about one in every three black babies conceived is aborted, so the incoming generation of blacks is being super-decimated. For white babies, it is about one in four that is are aborted, and for Hispanic babies, less than one in five. (The statistics that I am citing relate to both intended pregnancies and unintended pregnancies, but I found the abortion rates provided only for unintended pregnancies; I am assuming that within each race, the abortion rate for intended pregnancies is low enough not to change the general picture.)

Even with their high number of abortions, the fertility rate (live births per woman) for blacks, including black Hispanics, is presently higher than for whites, including white Hispanics, though only slightly, not enough to increase the black percentage of the population any time soon. But obviously, if there were no abortions, such an increase would indeed occur. So pro-life policies (halting abortions) would result in a significant proportional increase in the black population, and of black voters, in the US. US demographics, and their political impact, would change. (Assuming also that in relation to present proportions of different races in the US, immigration from black countries will not be lower than, or will be higher than, immigration from white countries, which I think is certainly the case.)

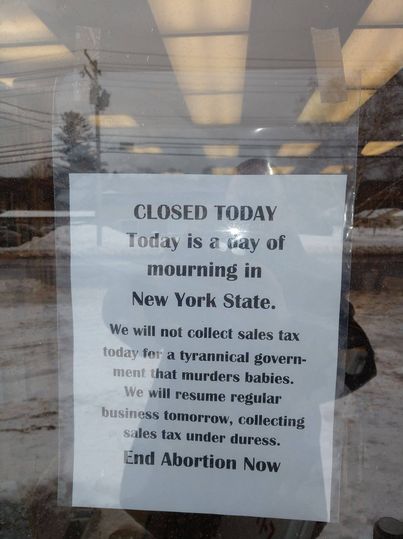

Now, in the US there is one party whose platform says We will repeal the Hyde Amendment (among other things), and one party whose platform says we . . . affirm that the unborn child has a fundamental right to life which cannot be infringed. We support a human life amendment to the Constitution . . . There are long and sordid tales to be told about the half-heartedness, fickleness, spinelessness, hypocrisy, and treacherousness of Republican politicians on abortion, but at the end of the day, the Democrats are clamoring for more and more abortions, while state-level pro-life laws, passed through support that has been overwhelmingly Republican, are saving unborn lives.

So here is the irony of it all, once the tributary stream of an unfounded belief feeds into the longstanding wider stream of the decimation of the black population through abortion: the Democrats get elected by virtue of the unfounded belief that Democrats are supporting blacks on a valid existential issue; then the Democrats take office and accelerate the decimation of the black population.

Now, it may also be true that Democrats in elected office in turn appoint more blacks to powerful appointed positions, and that Democrat voters vote more blacks into powerful elected offices in the first place, than Republican politicians and Republican voters do. But when these things happen, what blacks is it who end up in the powerful positions? It is the blacks handpicked by whites, whereas if there were more actual black voters (achieved by halting abortion), we would have blacks handpicked more by blacks. So even this seeming empowerment of blacks by the Democrats is not a true empowerment.

Just as I have not said anything here in defense of Derek Chauvin, except that there is no concrete evidence that he is a racist, I will not say anything here in defense of Republicans, except that they have been mainly responsible for state-level pro-life laws, and there is plenty of concrete evidence, mentioned above, that those laws have saved some lives. I am not a Republican. If I had to describe my political and economic views with just one word, the word would be “socialist.” On climate, immigration, healthcare (real healthcare), taxation (apart from taxpayer funding of abortion), and most issues, I am more closely aligned with the Democrats. So it is not due to any political bias that my analysis turns out as it does. Analyzing as objectively as I can, it is simply a fact: the Democrats, the party that appears to be standing up for blacks, is standing up for legal abortion (with the exception of a few such as John Bel Edwards and Katrina Jackson of Louisiana) and thereby is actually perpetuating the disempowerment of blacks (not to mention countenancing and financially promoting the direct black death toll of the abortions themselves). By financially promoting abortion they are pro-abortion, not just pro-life, and by forcing people whose consciences cry out against abortion to financially participate in abortion, they are rabidly pro-abortion. But my main point here is their political knee-capping of blacks through legal abortion and, if they have their way, subsidized abortion as well. It is they who perpetuate what is probably the worst systemic racism in the US, and it is the Republicans who oppose that one kind of systemic racism. But the real moral of the story would be to grow a new pro-life party that is better than either of our two political dinosaurs.

© 2021